Budget Frequently Asked Questions

How do I find my YTD salary recaptured amount and how do I request use of salary recaptured budget?

The salary recapture report is sent out monthly to all business managers. Simply search for your area on each report and total the amounts.

To request use of salary recaptured budget, please email the Provost Office (for Academic areas) or the AVP of Finance (for Administration areas) and copy your budget analyst, outlining amount needed, the purpose and the PCN being recaptured on from which you want to use the salary recaptured budget.

What am I supposed to do when I receive a budget notification email?

Click on the link the email provides or pull up the “Budget Statement Summary with Obligation Drill Down” report from WRL. The percentage over budget will be highlighted on this report. Correct any budget overages by submitting a budget transfer to the Budget Office and/or a journal entry to the General Accounting Office.

When do I need a budget amendment and how do I request one?

A budget amendment request (BAR) is needed during a fiscal year when (1) a department is requesting to recognize new/additional revenue and corresponding expenditure authority or (2) a department is requesting new expense budget. The form with detailed instructions is located on the Budget & Planning website.

How are salary increases, promotions, equity adjustments, etc. funded?

The following salary increases are funded centrally:

Increases per Union contracts (AAUP, AFSCME, CWA, UTPPA) including step/longevity,

annual increases and promotions;

“Across the board/merit based” increases as approved by the BOT.

Other increases such as equity adjustments, job audit increases, promotions outside

of the contracts, or re-filling a position at a higher rate than budgeted are funded

by the individual department requesting the increase. Note the AFSCME & CWA positions

which are over-filled are funded by a special fund held centrally. Please contact

your budget analyst if you have questions regarding a specific position.

To which department should I send the index rollup change forms?

All chart of accounts rollup changes should be submitted to General Accounting.

What is a 1x back btr and when do I need to submit one?

Whenever permanent (base) budget is transferred from a specific position mid-year, a 1x back transfer is needed. The 1x back btr returns budget on a one-time basis to cover any labor or salary recapture that has been charged against the position before the base budget was transferred.

Example: a base transfer moves $52,000 budget from a vacant, 12 month position to another position in the month of November. Since the position has been vacant, recapture would have been processed on the vacant position from July-October. The calculation is: $52,000 /26 pays * 8 (assuming 2 pays per month from July-October) = $16,000. $16,000 + fringes are transferred back to the vacant position.

Note: this only works if the budget to the new position is not needed until November. If the new position needs the increased budget before November then please contact your budget analyst to work out the details.

Should the amounts on a budget transfer always balance to zero?

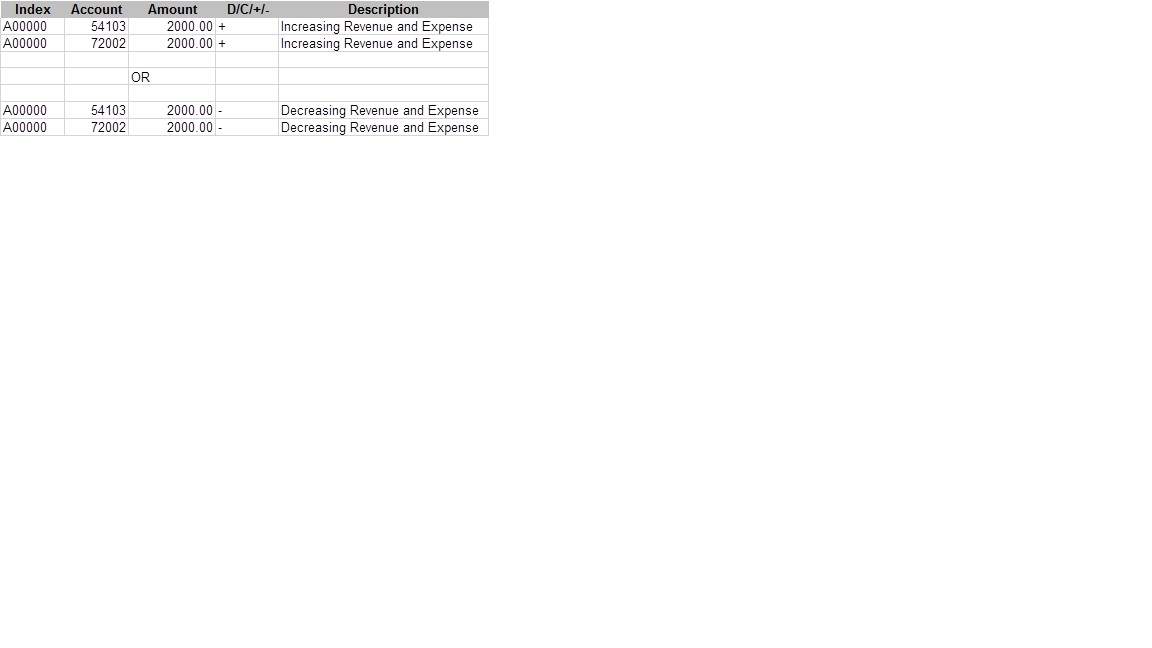

In most cases, a transfer will balance to zero. The transfer will not balance when it is recognizing a change in revenue and the corresponding expenses. The revenue and expense lines will show the same +/- sign.

Example: