1098-T Tuition Statement

The Form 1098-T is a tuition statement that colleges and universities are required to issue to students. It provides the total dollar amount paid by the student for what is referred to as qualified tuition and related expenses in a single tax year. 1098-T tax information will be available to eligible students on or before January 31 each year per IRS Regulations.

The University of Toledo provides Form 1098-T online through myUT portal for the student to view or print.

The dollar amounts reported on the Form 1098-T may assist in completing IRS Form 8863

- the form used for calculating the education tax credits that a taxpayer may claim

as part of their tax return. The responsibility of a properly completed the IRS Form 8863 belongs to the taxpayer,

not the University.

UToledo's staff are not permitted to offer any guidance or advice regarding the filing

of Form 1098-T. For further assistance, please consult IRS Publication 970.

Please review the Frequently Asked Questions below to learn more about the Form 1098-T.

FAQs

What is a Form 1098-T Tuition Statement?

UToledo is required to produce the Form 1098-T Tuition Statement by the IRS. This

form is informational only and is utilized for the purpose of determining a taxpayer's

eligibility for Hope, Lifetime Learning, or American Opportunity education tax credits

outlined in the IRS Publication 970.

Who is eligible to receive a 1098-T?

Each student who is enrolled and for whom a reportable transaction is made during

the calendar year.

Although your Social Security Number (SSN) or Individual TaxPayer Identification Number

(ITIN) is not a requirement for admission to UToledo, we are required to collect one

or the other for purpose of tax reporting.

If you need to provide your SSN or ITIN information to UToledo, please complete the

following:

- IRS Form W-9S; Complete Parts I and III on Form W-9S and include your Rocket Number in Part III under “Tuition Account Number”. The IRS can impose a fine to anyone failing to provide this information to the university no later than December 31st.

- Upload the completed IRS Form W-9S and your Social Security card or Individual Taxpayer Identification card to the university's secure site:

- Log into the secure site

- Enter your UTAD credentials

- Select IRS Form W-9S Student's Identification Number and Certification

- Locate the file by selecting Choose File

- Select Submit Form

Reviewing your Form 1098-T?

The IRS mandates institutions to report Form 1098-T information based upon payments

received for Qualified Tuition and Related Expenses.

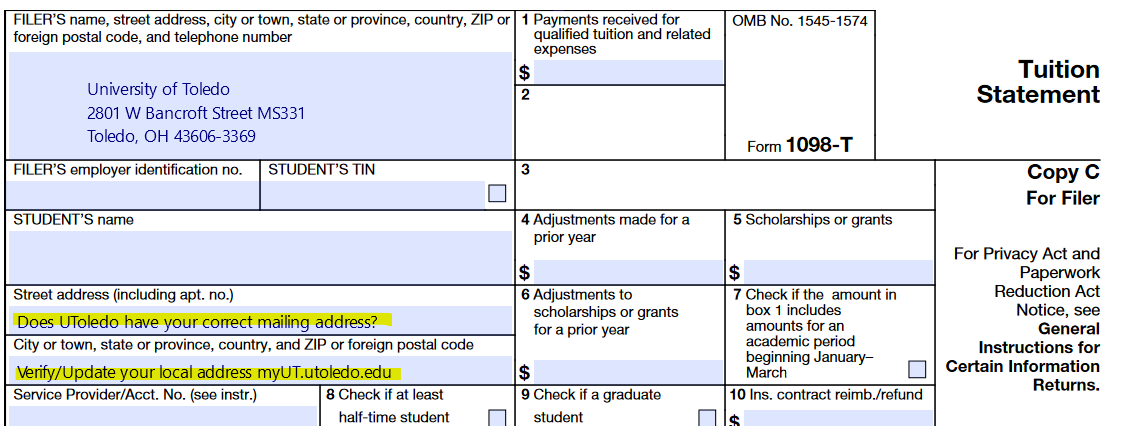

The following information is included on the Form 1098-T and reported to the IRS:

-

- Box 1 includes all payments received during the tax year towards qualified tuition and related expenses.

- Box 4 reports any adjustments made for a prior tax year. These adjustments may be

a result of either of the following:

- Payment Received - if a student was issued a refund or reimbursement of QTRE made in the current tax year that relate to payment received that were reported for any prior year.

- Amounts Billed - If the credit balance on the account was created in current tax year due to changes in payments for QTRE that were previously reported on a prior tax year 1098-T. Since spring charges are always billed in November/December of the prior year, these charges and related payments are accounted for on the 1098-T for the prior tax year.

- Box 5 includes all scholarships and grants paid toward a student's total cost of attendance during the

tax year. The total cost of attendance is comprised of tuition, mandatory fees, books

and supplies, room and board, student health insurance, etc. Box 5 includes scholarship/grant

payments toward the list of non-QTRE items charged to your student account. Examples

of Scholarships and Grants reported in Box 5:

- Corporation or employer under a third-party billing arrangement

- DoD Tuition Assistance and any other support for service members and dependents

- Federal Pell, SEOG, or other grants

- Institutional scholarships/grants

- Private nonprofit or other organization scholarship/grant payments

- Scholarships restricted to room and board

- State grants

- Veteran's benefits (Chapter 31, Chapter 33 (Post 911 GI Bill, and Yellow Ribbon)

- Box 6 is for adjustments to scholarships/grants made for any prior year.

- Box 7 is checked if payments received during the tax year towards QTRE on the 1098-T are for an academic period beginning January-March of the subsequent tax year. Spring charges are always billed in November/December of the prior year, which is why Box 7 may be checked.

- Box 8 is checked if enrolled at least half-time during any semester that began in calendar year current tax year.

- Box 9 is checked if a graduate student.

Why didn't I receive a Form 1098-T from UToledo?

Reportable transactions did not occur within the tax year.

How may I view and/or print my 1098-T?

- Log into myUT portal

- Select the Student tab

- Scroll down to My Accounts

- Select Tax Notification Form 1098T

- Enter the code for multifactor authentication

- Scroll to the Statements section, click on the appropriate form

Whom should I contact if I have questions regarding Form 1098-T?

Please contact the following if you need assistance:

- myUT portal provides detail information on the calculation for each box.

- Rocket Solution Central (RSC), Rocket Hall 1200 or call 419-530-8700.