Vacation & Sick Rollover to 403b & 457b

Can You Rollover Your Sick/Vacation Pay to your 403b or 457b when you retire?

Yes, you may rollover these funds into a 403b or 457b account. You will need to ensure you have the account set up with one of our approved vendors. This addition is subject to the yearly total maximum contribution. In order to ensure this rolls over properly, please enter the contribution amount you want rolled over into Retirement@Work or through Ohio Deferred Compensation, the day after your last regular pay. This will ensure it goes on your final vacation payout which is estimated to be around a month after your last regular pay.

Estimating Your Amount of Vacation/Sick Pay you will Receive

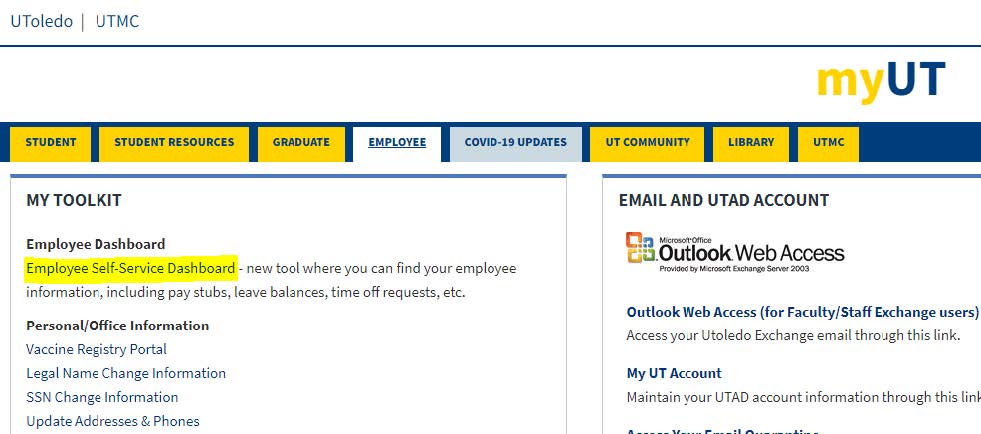

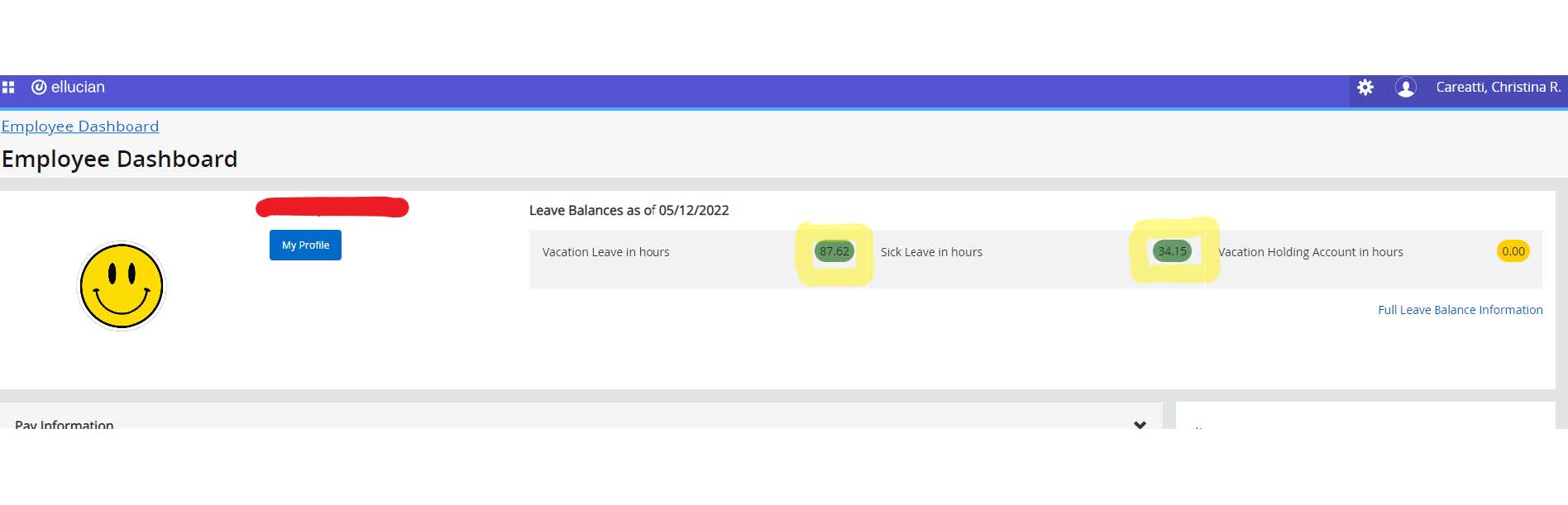

You can find this information by logging into MYUT’s Employee Self-Service Dashboard.

The Employee dashboard will have vacation and sick leave. Please refer to the sick

leave policy on how many hours payable you will have. Calculate from here your hourly

rate times the amount of hours to get your total that you will be getting paid.

403b

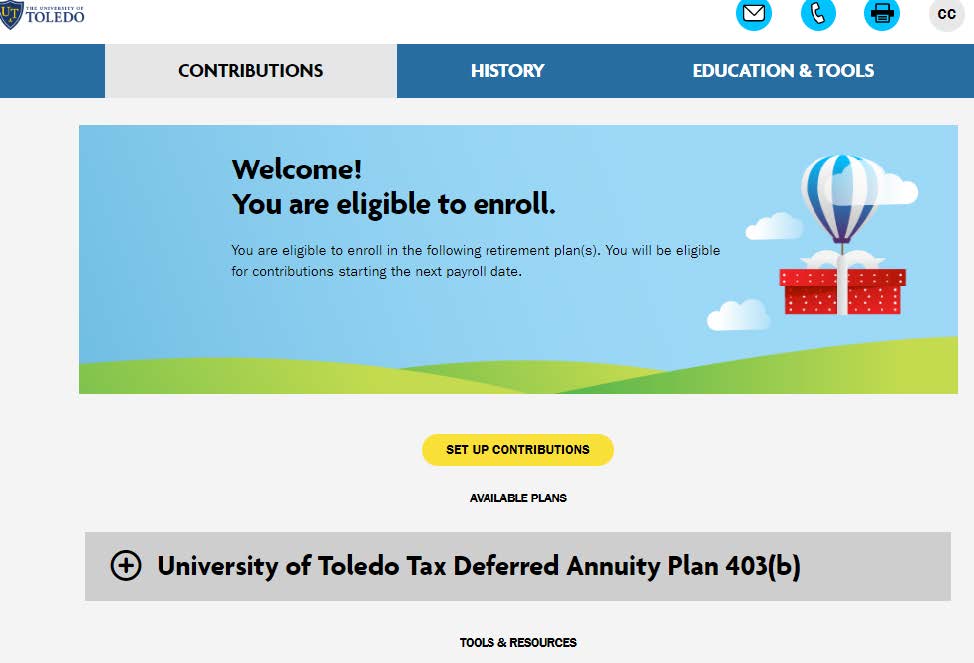

Log into your Retirement@Work login and click on the set up contributions tab. If you do not have this set up navigate to our Retirement Systems webpage and click on the voluntary 403b & 457b tab.

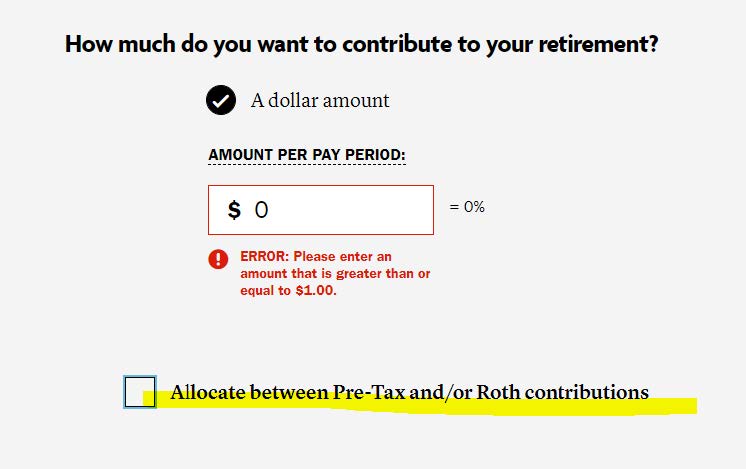

Place the $ amount you calculated into the box.

The Roth source can be chosen at this point.

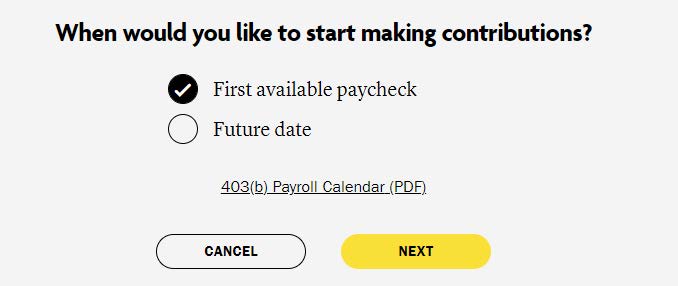

Choose when you will like to contribute. This is vitally important on timing. We suggest

you enter this the day after your Last Regular Pay. If you would like to enter a future

date, now is the time to click that.

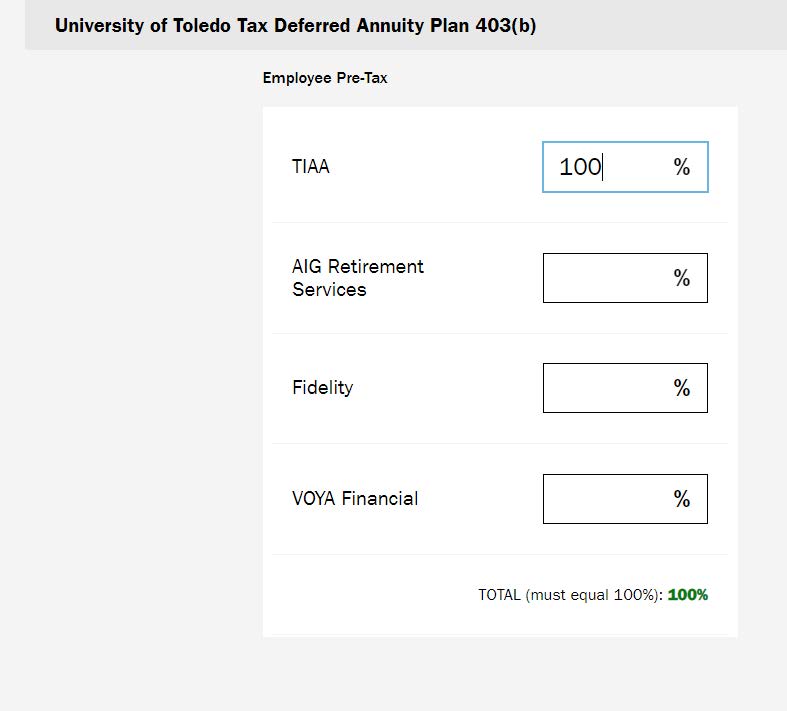

Ensure you place the percentage with the vendor you wish to contribute to.

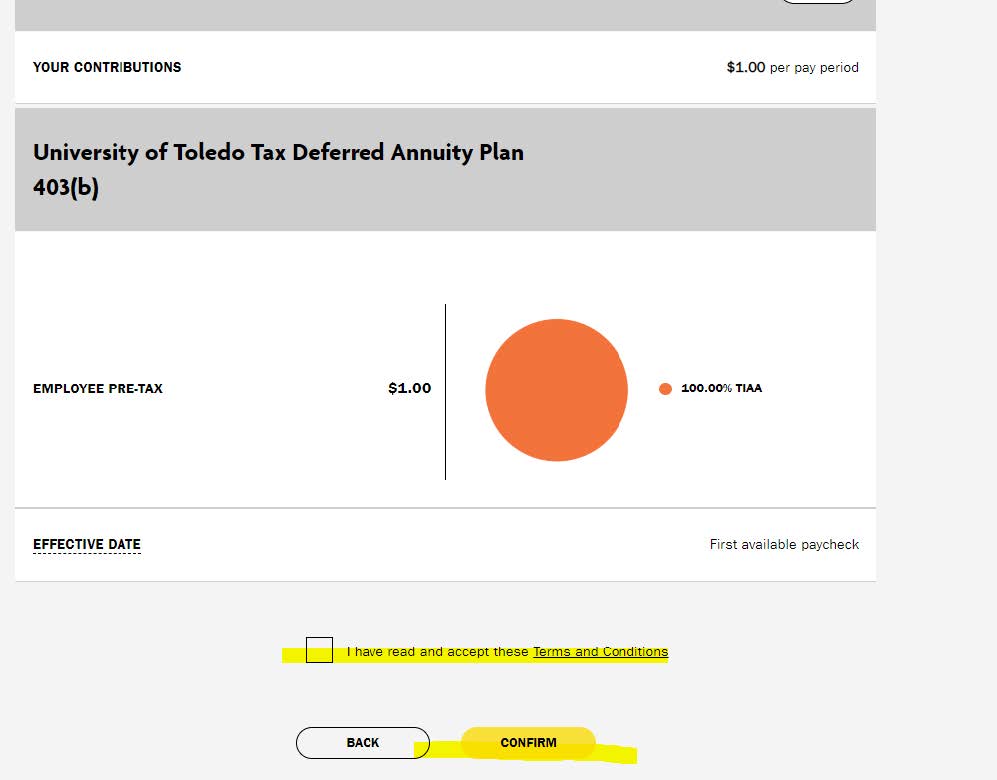

On the final page make sure you click you have read and accepted the terms and conditions and then confirm your request at the bottom. DO NOT MISS THIS STEP.

457b

Call Ohio Deferred Compensation to get everything set up 877-644-6457. *Reminder* timing is important.